It’s a common misconception that a commercial solar system comes with a large upfront cost. For an attractive solar project the loan repayments will be lower than the energy savings, meaning businesses can create a cash flow positive outcome from inception with no upfront costs.

Important: We note that none of this should be taken as financial advice, but rather as an introduction to each of the finance options available for commercial solar power. Please consult with your accountant or tax advisor before making a decision.

1. Paying cash for a Solar System

In general, businesses have limited working capital and many projects to fund. Often generating energy is not considering a core business activity and it can be hard to prioritise investment into a solar project, even if the is the most financially attractive. In most cases, paying upfront for solar will deliver the greatest total return.

| Pros | Cons |

|

|

Request a free solar business case and compare leading commercial installers

2. Energy-efficiency loans

The Clean Energy Finance Corporation has invested millions to help Australia’s major banks offer discounted ‘energy-efficiency’ loans. These loans typically offer a 0.70% discount on headline rates for investments into clean-energy assets and are available from Australia’s major banks. It is recommended to get a quote from a bank offering CEFC funded energy-efficiency loans to compare against existing business lending options.

| Pros | Cons |

|

|

3. Solar Power Purchase Agreements

Power purchase agreements (PPAs) are arrangements in which an organisation benefits from lower electricity rates without having to purchase a system. Instead, a PPA provider pays for and owns the solar system, selling the energy it produces to the business directly at an agreed-upon rate that is lower than energy from the grid. For more information on how Solar PPAs work and an example – Click Here.

Currently there are no industry standards or specific regulations in the solar industry for PPA contract terms, so it is recommended to seek advice before purchasing to ensure you are getting a competitive deal.

| Pros | Cons |

|

|

4. Operating lease / ‘Rent to own’ solar

Operating leases are designed to provide a fixed monthly repayment similar to an energy-efficiency loan however provide an ability for the company deduct repayments. After the implementation of new accounting rules (AASB 16) these leases will be treated as an ‘on balance sheet’ loan – see this article from compliance quarter.

We recommend seeking account advice on whether the repayments on these loans are tax deductible for your business.

| Pros | Cons |

|

|

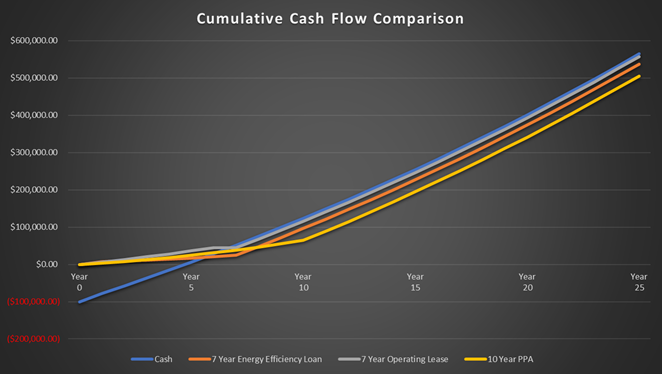

An example of Commercial Solar Finance Options for a 100kW Project

Project Assumptions

- 100kW system is in Sydney generating 124,813 kWh in first year and declining at 0.7% p.a.

- Business has an average electricity offset rate of 20 cents and system will export 20% of energy back to the grid

- Purchase price for system is $107,560 inc GST as per Solar Choice Price Index for 100kW

- Business can claim $6,800 of GST on purchase price

Financing Assumptions

- 7 Year Energy Efficiency Loan at 6% with monthly repayments of $1,571

- 7 Year Operating Lease at 7% with monthly repayments of $1,623 and a buyout clause of $10,000

- 10 Year PPA with flat rate 13c per kWh on total generation of system and no buyout clause

Which option is best for you? We can help you find out.

When it comes to financing a solar PV system, however, the best option really comes down circumstances and goals of the organisation in question. Solar Choice can independently model the impact of the different financing options using consistent assumptions enabling an apples for apples comparison.

To discuss your needs in detail, and for a free business case analysis and indicative quote comparison (including system size recommendation/estimation and indicative payback period), we encourage you to get in touch via the details below.

Request a free solar business case and compare leading commercial installers

Since 2008 Solar Choice has consulted with over 3,000 businesses around Australia and helped develop over 800MW solar commercial and solar farm projects.

- APsystems Battery Review: An Independent Assessment by Solar Choice - 18 December, 2025

- Running Cost of Air Conditioners – Explained - 7 October, 2025

- Air Conditioner Rebate South Australia: What You Need to Know - 19 September, 2025