Note: Solar Choice is an independent expert in Solar PPAs with experience advising businesses across commercial solar projects and utility-scale solar farms.

The difference between a Corporate Solar PPA and a Behind the Meter Solar PPA

| Corporate PPA | Corporate PPAs are agreements between a large-scale energy user and a power generator (e.g. a Solar Farm or a Wind Farm). Generally developers of power generators seek a fixed contract sale price for produced energy to provide certainty over returns for investors. Large-scale energy users can benefit from better pricing direct from generators and can effectively hedge their energy costs for a period of time.

As these agreements don’t require the power generator to be in the same place as the user, they are sometimes called “infront of the meter PPAs” |

| Behind the Meter PPA | Behind the meter PPAs are an alternative funding mechanism for businesses looking to install solar panels on their property. The onsite power plant is constructed and owned by a third party and power is sold through a fixed agreement to the business.

As all the energy is transferred to the customer behind the electricity meter – these agreements are called “behind the meter PPAs” |

This article is focused on behind-the-meter PPAs

So how does a behind the meter Solar PPA work?

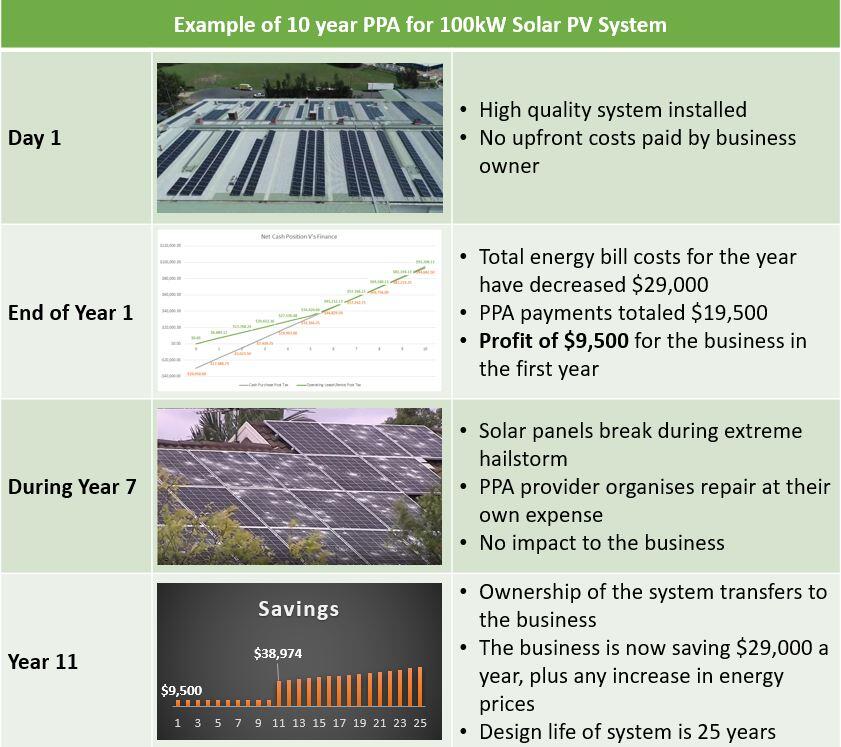

Solar Power Purchase Agreements (Solar PPAs) are one of a number of options available to a business to finance a solar project. Through a Solar Power Purchase Agreement (Solar PPA) a third party covers the cost of installing the Solar Power System at a business’s location and sells the energy generated from the system to the business at a lower rate than their retailer. Typically these third parties are financiers who are seeking to make a return from the revenue stream of selling the energy to the business. At the end of the agreement (usually 10 or 15 years) the ownership of the system along with the full benefits of free energy passes to the business.

Is the Solar PPA Provider the same as the Installer?

In most cases the Solar PPA provider is a separate third party and will not perform the installation themselves. If you received a Solar PPA offer from a solar installer, it is likely they are working with a bank or financing company to provide the Solar PPA terms.

Importantly there are a number of Solar PPA providers in Australia who are seeking to build a portfolio of projects. If desired, it is possible to retain control over which installer is performing the installation and how the system is designed and seek a third party Solar PPA provider.

What Solar PPA terms should I expect?

Unfortunately, there are no industry standards or legislation that regulate how Solar PPA are designed meaning it is important to understand the terms of the PPA you are being offered.

Often Solar PPA providers will introduce some or all of the below terms to enable them to provide the cheapest rate at the start of the contract:

- An annual rate escalator to match CPI or energy price increases (often 2.5%)

- A buy-out clause meaning business has to pay to assume ownership at the end of the contract or continue to buy energy

- An obligation to buy all (or a minimum %) of the energy generated by the system regardless of whether it is used by the business

- If the Solar PPA provider is an electricity retailer, they include an obligation to remain with them for the remaining grid electricity requirements through the duration of the contract

What are the pros and cons of a Solar PPA?

| Pros | Cons |

|

|

Why are so many companies using Solar PPAs?

Volatility in energy prices creates uncertainties around operating costs. A Solar PPA enables a business to create cost stability without needing to put up the investment costs. Unlike a lease or loan, a Solar PPA shifts the operational risk of under-performance or product failures to the Solar PPA provider who loses their revenue stream in the event of issues. This means there is less risk assumed by the business and a greater guarantee that a high quality system is going to be installed.

For a free consultation on your companies options with PPAs and solar power, contact Jeff Sykes at jeff@solarchoice.net.au

- APsystems Battery Review: An Independent Assessment by Solar Choice - 18 December, 2025

- Running Cost of Air Conditioners – Explained - 7 October, 2025

- Air Conditioner Rebate South Australia: What You Need to Know - 19 September, 2025