Reposit Power is an Australian battery technology company whose name has become synonymous with battery storage value maximisation. The company’s software does two important things for homes with battery storage systems:

- it makes sure that batteries are always charged in the most cost-effective way possible (whether that be solar or off-peak grid electricity), and

- it allows battery system owners to be handsomely rewarded for sending their stored energy into the grid at strategic times (‘GridCredits’).

It’s arguably the second point that has earned Reposit its reputation in Australia’s burgeoning battery storage field. For the first time, ordinary households and businesses are able to proactively participate as generators on the National Electricity Market, contributing energy when it is needed most – and being compensated accordingly.

The reality is that modern-day solar feed-in tariffs – at around 6-8c/kWh in most places – offer no incentives for solar system owners to put their energy into the grid. In fact, solar households are best off self-consuming as much of their solar energy as possible – which is why batteries are in demand in the first place.

The reality is that modern-day solar feed-in tariffs – at around 6-8c/kWh in most places – offer no incentives for solar system owners to put their energy into the grid. In fact, solar households are best off self-consuming as much of their solar energy as possible – which is why batteries are in demand in the first place.

One of the biggest questions that we’ve always had about Reposit’s GridCredits platform is how often GridCredits events occur, and what rates are paid during each event. The recent heatwaves across Australia’s eastern seaboard have brought this question into sharp relief, however, as high demand for electricity drove wholesale electricity prices through the roof – as high as $14/kWh at one point in NSW.

We caught up with Reposit Power to get an idea of how homes with their technology were faring in the recent electricity market upheaval – and what else the company has in store for the future.

Q: Wholesale electricity prices have been quite high this summer. As we understand it, this makes perfect conditions for Reposit system owners. Can you share with us some examples of how your customers have benefited from this volatility?

Wholesale electricity prices have been quite high this year and many Reposit GridCredits customers have benefited from the volatile market.

When electricity demands are high, Reposit will automatically trade excess energy for GridCredits. Every GridCredit earned, is another dollar off your power bill.

For example – considerable electricity market volatility occurred over 14 days earlier this year, and on some days the electricity spot market spiked several times. Over the two weeks, customers sold a total of 40 kWh – shaving about $40 off their power bills.

Customers in QLD, NSW, ACT, VIC and SA have received several GridCredits events since the beginning of the year.

Currently Diamond Energy and Simply Energy are the only two retailers to offer GridCredits plans.

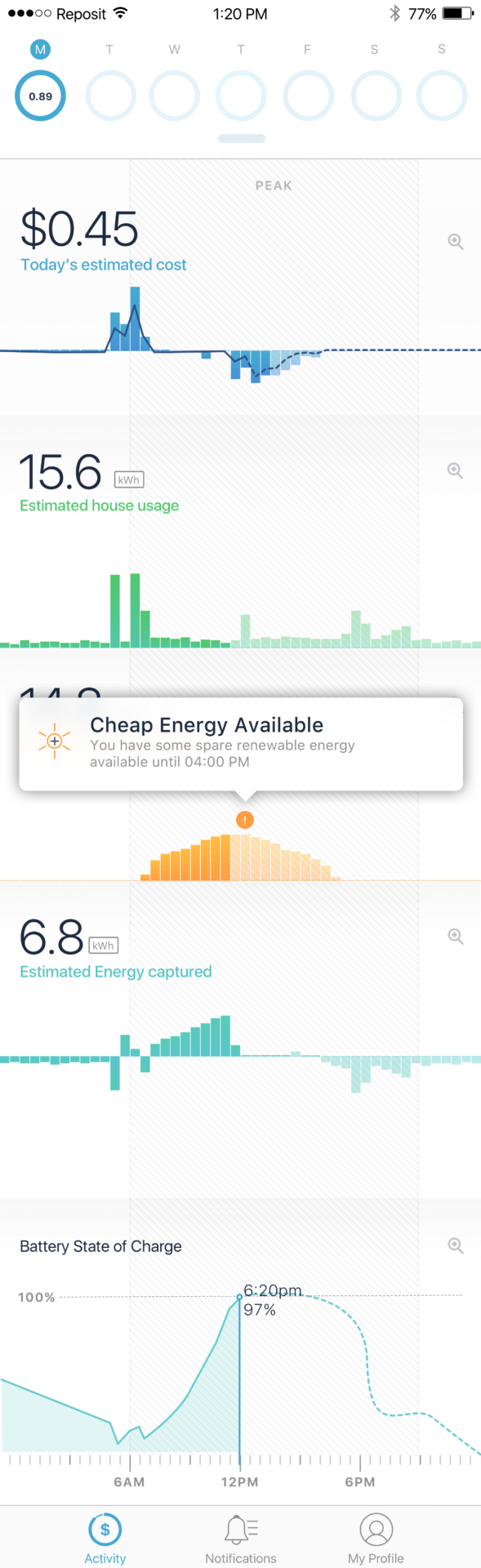

A screenshot of the Reposit Power phone app, showing an example of amount earned through GridCredits, as well as other energy consumption details.

Q: Currently, Reposit system owners must be paired up with a Reposit-compatible electricity retailer to receive GridCredits. The retailers are the ones who set the GridCredits amounts. What sort of flexibility do they have in determining how GridCredits benefits are delivered to Reposit system owners?

To get GrdiCredits, Reposit system owners must be paired with a Reposit-compatible electricity retailer. At the moment, Diamond Energy and Simply Energy offer GridCredits plans.

Currently the plans are fixed – homeowners receive a $1 for every 1kWh that a retailer buys. Retailers have full control over what plan they put into place.

GridCredits differ from a normal feed in tariff. Feed in tariff rates are fixed and money is earned when homeowners have excess electricity which has nowhere else to go. But, GridCredits are earned when a retailer buys energy when they need it. This earns homeowners a higher than normal price for the energy they feed back into the grid for a short period of time.

Because GridCredits are a new technology, retailers have set a fixed price to better understand the technology. In the future, we hope to have dynamic GridCredits plans which will allow customers to have more exposure to the electricity market spot price.

Basically, we hope to see a floating tariff plan – as the market changes so does the price you pay for, and discharge electricity – offering more opportunity for homeowners to lower their power bill.

Q: Are there any other grid benefits/services that battery system owners can hope to be compensated for in the future, such as frequency correction or local grid ‘node’ demand mitigation?

You’ve been reading our mind. FCAS GridCredits options are currently under development. There are two components to this:

- Contingency market (the replacement reserve) – this is reserve power that is used to relieve generators and stabilise the market.

- Voltage control – the frequency of the grid is designed to vary slightly. When the grid is very heavily loaded, the frequency slows, and when the grid is lightly loaded the grid frequency runs above the nominal frequency.

- With Reposit, homeowners can offer both contingency and voltage control services to networks and be paid handsomely for their efforts.

GridCredits are already earned for demand response – so when power is needed (not always based on electricity market spot price), networks can access our system and use the electricity to stabilise the Grid.

Q: How about consumer preferences? What if I want to buy electricity from my Reposit neighbour when they have it available? Does a Reposit system make that possible?

This is technically feasible – Reposit hardware can do this. But, there is a lot of work involved in getting to that stage – it’s not as simple as pushing a button (yet).

Q: What else has Reposit Power got planned for the near future?

We have several projects we’re working on.

- Project Consort – Based at Bruny Island in Tasmania, this project is a collaboration between Australian National University, University of Sydney, University of Tasmania, Tasmania Networks and Reposit. It aims to test consumer owned storage capability in offsetting the need for costly diesel generation on the island during peak holiday periods, and how to effectively reward customers for their efforts. So when the Grid needs extra electricity, the network can draw from homeowners on the island, and pay them for contributing.

- Networks Renewed – This is two trials, one with Essential Energy’s network in the Port Macquarie area, and one with United Energy’s network in the Melbourne area. The aim is to test the ability of smart storage and PV control to balance voltage on the grid. Occasionally there are spikes in voltage to the Grid, Essential and United are testing how smart storage systems can assist to control the voltage spikes.

- SAPN Sailsbury Trial – A 100 South Australian Power Network customers in Salisbury Adelaide are helping to test the ability of batteries in providing network support services. Again, when the Grid becomes volatile, customers with smart solar storage systems can provide electricity to prop up the Grid.

- deX – A collaboration between United Energy, ActewAGL Distribution, GreenSync, Reposit, Mojo Power, the Australian National University and the ACT Government. This project is aimed at designing and piloting a prototype digital exchange (deX) for trading Distributed Energy Resources (DER) between customers and networks. You might have seen this in the news recently.

- NextGen – This is an ACT Government project to encourage 5,000 households to install smart solar battery systems across the ACT over the next four years.

© 2017 Solar Choice Pty Ltd

- Solar Panel Costs: Solar Choice Price Index | April 2025 - 1 April, 2025

- Solar Panels For Homes – All You Need to Know About Solar Systems - 18 March, 2025

- Best NSW Solar Feed-In Tariffs - 17 March, 2025