Electricity retailer Powershop and battery control technology developer Reposit Power have come together to offer a first-of-kind product to battery storage system owners in Australia. Anyone with a (Reposit-equipped) battery storage system living in New South Wales, Victoria or Queensland can sign up for the program (called Grid Impact) to become part of a massive, distributed ‘virtual power plant’ (VPP) and get paid accordingly.

The gist (tl;dr)

- Powershop & Reposit join forces to offer a retail virtual power plant (VPP) plan for battery owners

- Battery owners signed up for the plan get paid a flat quarterly fee for letting Powershop occasionally tap into their batteries

- Rates paid depend on the size of battery and state where it is installed

In a nutshell, the Grid Impact plan pays customers owners a flat, quarterly credit for the option to occasionally use their batteries. It’s not 100% clear how often Powershop would tap into their customers’ battery capacity, but indications are that it would only be a handful of times over the course of the year – concentrated mainly in the summer, when electricity market spot prices tend to be highest due to high electricity demand (mainly from air conditioners). The fee that Powershop pays depends on output rating of the battery system (in kilowatts) and the state, with VIC fetching the highest rates and QLD and NSW earning lower payments.

For this plan to make a meaningful (grid) impact, there would need to be a lot of households signed up for it – and this number would be limited by the number of locations with a Reposit Box and battery bank installed. When I pressed Reposit’s Dean Spaccavento for numbers, all he could tell me is that the amount of battery storage capacity equipped with Reposit’s technology was ‘in the megawatts’, which presumably means numbers in the thousands range.

The program differs from other virtual power plant programs out there in a few ways. Firstly, it is not a pilot project – this is a real commercial offering available to anyone with the right equipment in the right regions. Secondly (and relatedly), the program is not government-sponsored. Thirdly, customers bring their own batteries and have no obligation to remain part of it for any period of time – they’re free to come and go as they please.

Compare Solar & Battery Quotes

Here’s a bit more about Grid Impact, from the perspectives of the various parties involved.

What’s in it for customers/households?

What’s in it for customers/households?

People who have or are thinking about getting batteries probably have ‘energy indepdence’ in mind, but the reality is that the vast majority of the people who get batteries will, in fact, maintain a connection to the grid. While this may seem counterinutitive for a lot of people, the fact is that most solar & battery systems cannot supply all of a home’s energy needs 100% of the time throughout the year – even if they’re mostly independent of the grid. (Also keeping in mind that going off grid requires installing lots of excess capacity to make it through days of bad weather – and no feed-in credits for excess solar energy.)

This means that there are hundreds to thousands of households & businesses out there with batteries who are likely to be drawing very little power from the grid, but still relying on it as a kind of gigantic backup power supply. At the same time, in possession of batteries, they have something that is of definite, immediate use to the country’s electrical infrastructure: instantly dispatchable power. Battery banks work like gas turbines or hydro plants, but are quicker to discharge and take less time to build (case in point: Tesla’s Big Battery in SA). On top of all this, battery banks don’t have to be located all together in one place – it’s possible to have megawatts of capacity spread across a region and have basically the same impact as a centralised plant.

So if you’re a retailer, what do you give to the (nearly) energy self-sufficient home that (almost) has it all? You tap into their untapped potential and pay them to be a generator. Or more specifically, you issue a flat quarterly payment to them to be on standby as a generator – even if you never end up exercising that option. (More on the situation from a retailer’s perspective below.)

Main benefits of Grid Impact:

- Participants still have all the same savings associated with their solar & batteries, minus the occasions where Powershop taps into the batteries (but the quarterly credits will probably outweigh this)

- Participants get set, quarterly Grid Impact credits on their (already small) electricity bills – as per the table below

- Participants are part of the electricity system of the future

- No lock-in contract – if better ones come up, customers are welcome to take their batteries elsewhere

- (That being said, customers do need to be with Powershop if they want to have access to this particular type of benefit, which means they accept the rates & terms that Powershop put forward for those who sign up.)

How much will customers get paid?

All credits paid out under a Reposit-enabled programs are referred to as ‘GridCredits‘. In the case of Powershop’s Grid Impact plan, GridCredits are applied to customers’ bills every 3 months. The table below details the rates by state and battery size.

| GridCredits (yearly) | Small battery

(less than 3.5kW) |

Medium battery

(between 3.5kW and 7.5kW) |

Large battery

(7.5kW or more) |

| Victoria | $100 | $156 | $236 |

| New South Wales | $34 | $68 | $124 |

| Southeast Queensland | $20 | $40 | $80 |

So what are the downsides to the plan?

As for downsides, there really aren’t any obvious ones. The biggest hurdle is that customers must own a battery bank as a prerequisite to joining – and batteries are still pretty pricey. The other potential downside to the plan is that once in a while Powershop will basically take over the customer’s battery and discharge it for their own purposes, which means that the owner won’t be able to use it like they usually would. This could mean slightly decreased savings from their batteries. The other side of the coin, however, is that Powershop takes the risk that your battery may be empty when they need it (so make sure you always get to your stored energy first!)

It’s also worth noting that while a more lucrative, battery-friendly plan may come onto the market at some point into the future, at this point in the time Powershop’s Grid Impact and Diamond Energy’s GridCredits100 programs are the only two in the game.

How often will Powershop use their customers’ batteries?

No one knows exactly how many times Powershop will need to tap into their customer-based virtual power plant (that’s the nature of ‘hedging’ – see next section), but their estimates are 2-10 times per year for Victorian customers and a bit less than that for NSW and QLD customers.

Reposit and/or Powershop will presumably let you know via a notification (app, email or text) that a Grid Impact event is about to occur so that you know if you’re going to have a bit less battery capacity available that day. (on the upside, you’ll have the satisfaction of knowing that you’ve just contributed some clean energy from your home into the grid instead of hoarding all of your system’s powers and abilities to yourself.)

What’s in it for Powershop?

Powershop is an electricity retailer, which means they sell electricity (they don’t deliver it to you – that’s the job of the local electricity network). Powershop is different from many other retailers in a number of ways (mainly their monitoring app and interactive ‘Power Packs’ that allow customers to purchase different ‘types’ of energy) but at the end of the day they are a retailer.

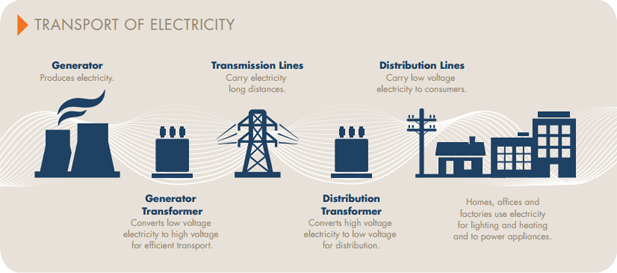

The core job of an electricity retailer is to manage the risks associated wholesale electricity prices on the National Electricity Market (NEM) and deliver predictable pricing to their customers, accounting for each unit of energy that their customers purchase from (or send into) the grid. These spot prices change every 5 minutes and are (currently) tallied up into 30 minute chunks. For a household that just wants to know what they’re going to pay for electricity, purchasing energy wholesale isn’t attractive or financially viable (and you need a license to do it anyhow because it’s hairy business).

The National Electricity Market (NEM).

This means that if spot prices over your billing period end up being higher than Powershop anticipated when they set your rates, they are caught out of pocket. Conversely, if wholesale rates are lower than expected, they don’t pay you back the difference – they’re there to give you predictability, so you get what you signed up for. (Although we should also note that in Powershop’s case, you actually can ‘buy in’ to discounted packages – called Power Packs – that allow you to tap into special lower package rates when they are available).

Retailers can just take their chances with the wholesale electricity market if they really want to, but in practice all of them set micro-contracts called ‘caps’ (or contracts for difference) with generators to purchase electricity at set rates at some point in the future. They can purchase these directly from generators (e.g. coal or gas plants), but they can also come from other places (such as energy traders). When spot prices look likely to get high, they have these caps on hand to help keep costs under control. The better a retailer is at forecasting what the market will do and planning accordingly, the more affordable their electricity can be (at least in theory).

Using customers’ batteries lets Powershop better hedge their spot price bets

So the point is that with Grid Impact, Powershop has put together a program where they can essentially use their battery-owning customers as generators (the VPP idea) and give them a cap-like payment to hedge their bets on wholesale electricity price.

In fact, retailers like Powershop already (kind of) do this with when they give you a feed-in tariff for your excess solar power (which helps to hedge their wholesale liabilities), but feed-in tariffs are not particularly lucrative for retailers because the solar power homes provide is not necessarily there when retailers want it. (In fact, many pricing peaks happen just on the outside of the solar production window – when solar is no longer flooding into the grid from hundreds of thousands of homes, businesses and solar farms.) Batteries, on the other hand, can be discharged precisely when their energy is needed.

Of course, Powershop also benefit from potentially gaining a heap of new paying customers – although there’s a reasonable chance that these new customers have so much solar & battery power that they rarely purchase any from the grid.

What’s in it for Reposit?

What’s in it for Reposit?

And sitting behind all this is Reposit Power, the company whose technology enables Grid Impact. Households who own a Reposit-equipped battery system don’t need to be signed up for any GridCredits plan at all, but access to such these specialised offers is one of the things that makes Reposit’s technology unique and in-demand. (They also have a sleek and intuitive energy monitoring platform what works without batteries, as well as sophisticated charge/discharge algorithms that maximise the value that batteries can deliver.)

At the end of the day, Reposit wants to sell more of its devices. The more GridCredits-compatible electricity plans that are available, the more choice their customers have and the happier those customers will be (and the more good press Reposit will get). Reposit sees its role in the burgeoning battery & smart grid markets as the breaker of chains – unlocking the value of distributed batteries to make the grid cleaner and more efficient.

What’s next?

It will be interesting to see how many people end up signing up for Grid Impact or similar programs going forward – if such figures are ever made public. In any case, this is just one example of the direction that Australia’s electricity grid is heading in – and there will undoubtedly be plenty of similar (copycat?) programs appearing in the coming years.

In the meantime, anyone who is interested in joining Grid Impact can learn more here.

Compare Solar & Battery Quotes

- APsystems Battery Review: An Independent Assessment by Solar Choice - 18 December, 2025

- Running Cost of Air Conditioners – Explained - 7 October, 2025

- Air Conditioner Rebate South Australia: What You Need to Know - 19 September, 2025

Here in SA (see Technical Standard 129) and in other states, network companies are limiting the exportable power on new solar PV systems to 5kW. So, if you already have a few kW of PV on the roof and you want to get a Powerwall 2 that comes with a 5kW inverter, how will systems be configured so that comply with the new standards?

My own view is that there is no justification for the new 5kW limit and is simply a clever way of limiting the growth of solar PV. Network companies are using this as a cop out so that they don’t have to invest as much in developing the network to allow it to handle bi-directional flows and to improve voltage regulation. Why has there been no discussion about this in the press? These new standards are a direct attack on the solar PV industry.

Hi Steve,

First off it’s worth noting that – interestingly – Grid Impact is not being offered in SA. I’m not sure why not or if that will change in the near future.

In SA it is technically possible to get a Powerwall 2 installed alongside a 5kW solar system, but you’ll need dual or 3-phase power to do so (the SA Power Networks limit is 5kW of inverter capacity per phase).

The work-around for single phase homes is to put batteries behind a hybrid/battery-ready inverter with a capacity of (no more than) 5kW. There are plenty of options out there besides Powerwall 2 – although for most of them customers will end up paying more per kWh of battery capacity (TP2 is one of the best value-for-money products on the market). That being said, most households would probably be better off with a smaller battery (in the 5kWh range) than something as large as TP2 (which is 13.2kWh), which could mean a smaller spend for the battery bank.

I have recently installed a 5kw battery system and have a smart meter I have not given any permission for any one to use my battery storage but on quite a few occasions my computer graph shows a large battery transfer to the grid usually for only a short spike

Hi Kevin. It’s possible that’s some sort of data logging error or the result of an overlap as your batteries kick in. What monitoring system are you using?