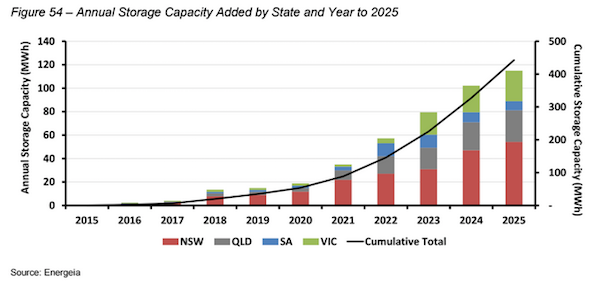

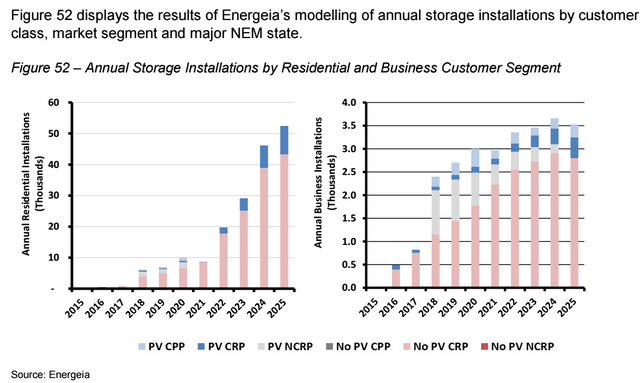

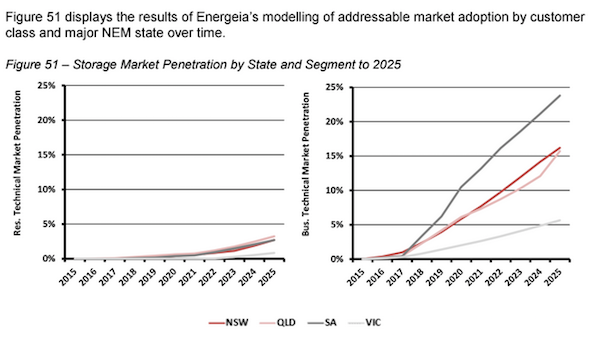

Australian households could be installing battery storage systems at a rate of 55,000 a year within just 10 years, a new report has found.

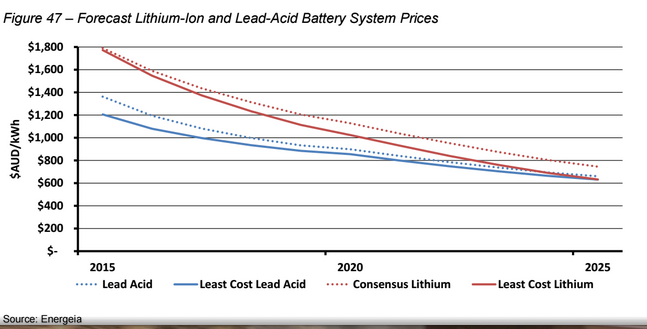

The report, Sound and Fury – Australia’s Distributed Energy Storage Market to 2025, by energy research group Energeia, predicts that demand for battery storage will be booming by 2025, as system prices fall, feed-in tariffs are wound back, network and retail tariffs become more cost reflective, and energy services business models gain traction.

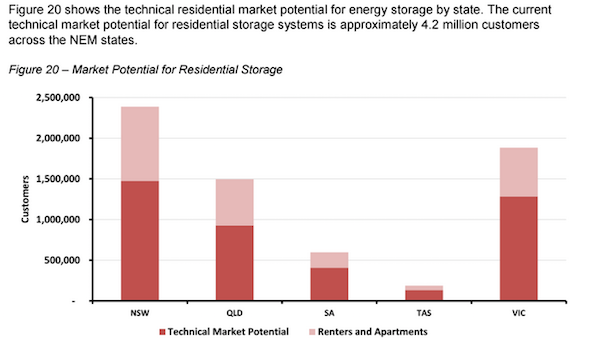

And while some of this demand will come from existing rooftop solar customers, Energeia senior analyst Richard Murray says the vast majority is expected to come from customers with the right kind of load profile, including late afternoon peaks, and access to a truly cost reflective retail and network tariff.

And while some of this demand will come from existing rooftop solar customers, Energeia senior analyst Richard Murray says the vast majority is expected to come from customers with the right kind of load profile, including late afternoon peaks, and access to a truly cost reflective retail and network tariff.

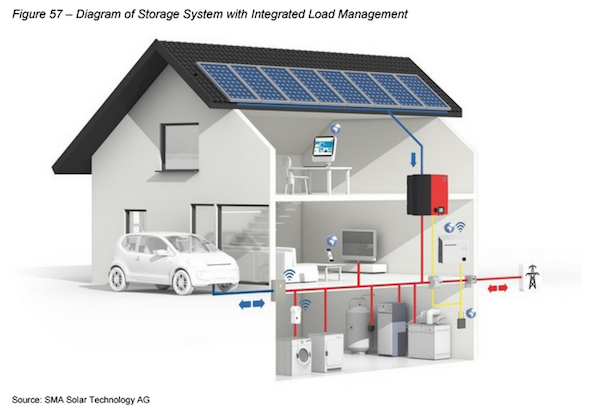

“By 2020, we expect most new customers will be installing solar PV-storage systems,” the report says. “Our modelling shows the most popular storage systems to be in the 3-4 kWh range and tightly coupled with solar PV systems, sharing a common inverter and monitoring and control system.

“This will help minimise the cost of the overall system, which is likely to also include load control capabilities to optimise flexible loads such as hot water, slab heating, pool heating and pool pumping.”

“This will help minimise the cost of the overall system, which is likely to also include load control capabilities to optimise flexible loads such as hot water, slab heating, pool heating and pool pumping.”

Energeia notes that the range of available storage solutions has increased significantly since its last report on the technology in 2012, with the majority of new units designed to drop into an existing solar PV circuit to reduce system costs by sharing the inverter.

But it warns that battery developers have yet to fully grasp distributed storage (DS) economics, and Energeia’s assessment is that none of the units currently available provide a truly cost effective or complete “set and forget” solution – a gap it expects will be bridged by the emergence of bolt-on software programs.

According to Energeia’s modelling, the key drivers of demand for distributed energy storage over the next 10 years will be retail and network tariff levels, tariff structures, FiT levels and falling technology prices.

The report, also suggests there will be little in the way of policy and regulatory support for storage in the medium term, and that successful players in the solar plus storage market will transition to services business model that leverages storage.

The report, also suggests there will be little in the way of policy and regulatory support for storage in the medium term, and that successful players in the solar plus storage market will transition to services business model that leverages storage.

“The latest research report dispels the sound and fury of the current crop of would-be storage players, solutions and strategies as ultimately signifying nothing with respect to the main …opportunity,’’ said Murray.

“The latest research report dispels the sound and fury of the current crop of would-be storage players, solutions and strategies as ultimately signifying nothing with respect to the main …opportunity,’’ said Murray.

“Instead, we see the ultimate winners as those whose strategic positioning best reflects the fundamental economics of storage.’’