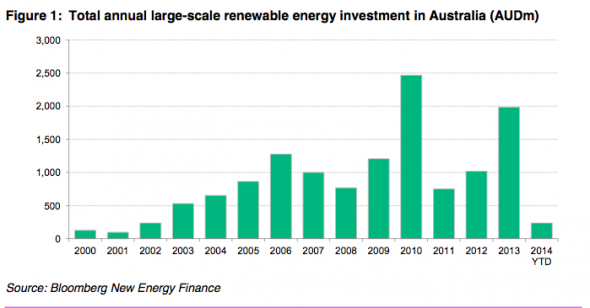

A report from Bloomberg New Energy Finance shows that Australia is on track to record its lowest level of asset financing for large-scale renewables since 2002, with just $193 million committed in the third quarter of the year.

This has seen Australia drop from its 2013 top-five ranking in the global renewable investment stakes, to 11th place, behind Algeria and Myanmar.

According to BNEF, the “severe downturn in investment – and total freeze in private investment – has been caused by the Abbott government’s review of the Renewable Energy Target.” Says the report: “Its controversial review panel recommended scrapping the target or radically diminishing it in August, but the government is yet to announce its position and faces blockage in the Senate to changes.

“Private investment is likely to remain frozen until the government’s position is clarified, which is expected in the coming months. However the hiatus in investment will continue for several years if the recommendations of the review panel are not rejected.”

And the effect is plain to see. A total of 7 projects have been financed since the start of the calendar year – all are the subject of government funding through the Australian Renewable Energy Agency, Clean Energy Finance Corporation or state governments. None were backed by non-government lenders or investors.

In the first two quarters of the year, there was just $45 million of financing.

This contrasts with the continuing surge in rooftop solar – mostly for the purposes of self consumption – and the growing boom in renewables investment across the world.

Globally, clean energy investment in the first three quarters of this year was 16 per cent ahead of the same period of 2013, at $175.1billion.

The highlight of the third quarter was a leap in Chinese solar investment to a new record of $12.2 billion. China is building a large number of utility-scale photovoltaic projects linked to its main transmission grid.

In Japan, investment grew 17 per cen to $8.6 billion, with solar again the dominant renewable energy source. Other countries showing a bounce in investment in the latest quarter were Canada, France and India, while there were significant projects financed in a number of new markets, including Myanmar and Sri Lanka.

Michael Liebreich, chairman of the advisory board at BNEF said the figures were heartening, but still not enough to herald the “rapid transformation of the power systems” that is required. That would require investment of $200 billion and $300 billion a year.

The third quarter figures showed that global investment in wind farms, solar parks and geothermal plants reached $33.3 billion, a slight rise on year earlier figures, while investment in small-scale projects such as rooftop solar was $18.3 billion, up nearly a third from a year earlier.

The best hope for the Australian renewable energy industry is that the government can quickly reach a deal with the Labor Party and the industry on the way forward.

The ALP has indicated it may be prepared to defer the target to 2022, the Clean Energy Council has indicated it could accept an exemption for the aluminium industry.

Meanwhile, the Australian Financial Review reports that Industry Funds Management is being forced to write down the value of Pacific Hydro, the largest specialised investor in renewables in the country, by $685 million.

Infigen Energy, the largest listed investor in renewables, is also reported to be facing massive writedowns, and has flagged taking dramatic action to protect shareholder funds.

Infigen has also brought Australian investments to a halt, as has Silex Systems, which has effectively abandoned the solar industry.

International investors have also made clear that their investment in Australia will end soon unless policy stability is restored. These include First Solar, Chinese wind turbine leader Goldwind, and numerous others. The US-based Recurrent Energy has already packed its bags, Spanish based FRV has said its $1.5 billion pipeline is at risk.

© 2014 Solar Choice Pty Ltd