Australia’s residential battery storage market could be worth $24 billion, with half of all households likely to install batteries to store the output from their solar panels, according to investment bank Morgan Stanely.

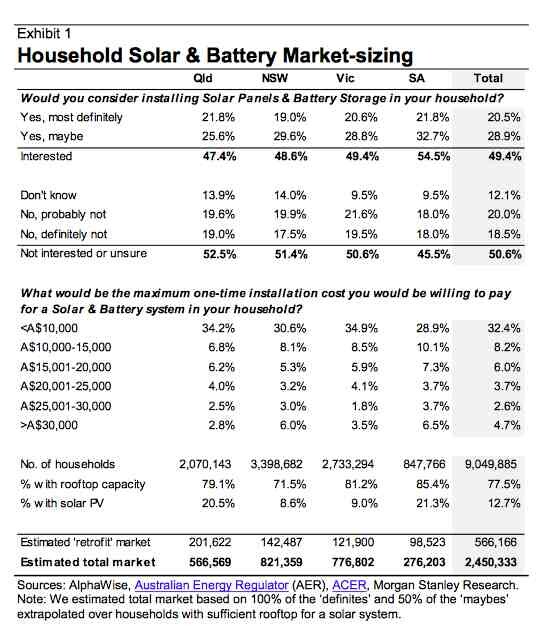

The bullish prediction – based on a survey of 1,600 households, and the subsequent release of the new Tesla Powerwall battery storage offering – means around 2.4 million households in the National Electricity Market (all states except WA and Northern Territory and off-grid areas) would install batteries, more than the double the 1.1 million households that already have solar in the NEM.

That, says Morgan Stanley, is likely to impact the incumbent electricity utilities, cutting earnings and forcing asset write-downs.

So much so, the investment bank has slapped a “cautious” tag on its outlook for the industry, suggesting they could be badly hit by lost revenue in coming years.

Morgan Stanley’s conclusions came about from a survey it commissioned from 1,600 households, and the subsequent release of pricing by the new Tesla Powerwall battery storage offering.

The survey – conducted in March before the Tesla release at the end of April – found half of all households had a strong interest in household solar and battery product, with a clear $A10k price point and 10-year pay-back period.

“Battery adoption should follow solar adoption patterns (literally and figuratively) which, in our view, suggests a market of about 2.4m NEM households,” the analysts write, noting that around 1.1m households in NEM already have solar panels.

“We think there will be strong interest in household solar and battery products, which transfer value away from the incumbent merchant utilities,” they write.

“We think household battery take-up will follow a similar pattern to household solar take-up, especially seeing as around 1.1m households in the NEM could ‘retrofit’ their existing solar systems with batteries, especially where legacy Feed-in-Tariff schemes are set to expire.”

These are the results of the survey that Morgan Stanley undertook. Most people, naturally, are going to take up battery storage at a certain price-point, a ten-year payback. Many, though, will buy even at a higher price point.

It’s interesting to note that the “retrofit” market accounts for one-half of current solar households. That takes into account that fact that many households in Queensland, Victoria South Australia, where a total of around 400,000 homes have generous export tariffs until the mid- to late 2020s, have no incentive to store their output in batteries.

But there is also potential interest from the 160,000 homes in NSW, 60,000 households in Victoria and 30,000 households in South Australia that will see their tariffs expire next year.

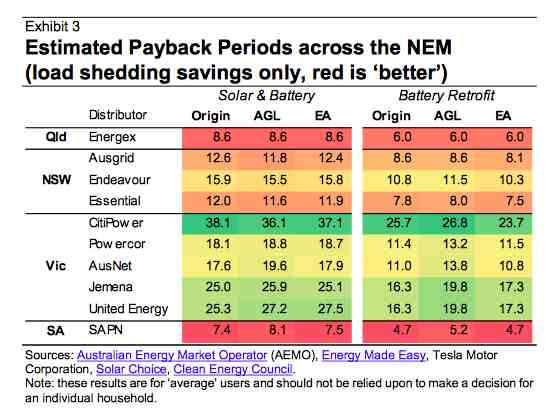

Those tariffs are important to note in this next graph, which shows the estimated return on investment and payback times for households adding battery storage.

The excellent returns in Queensland and South Australia are for those who do not have those premium tariffs. They both pretty much accord with the UBS estimates we published on Tuesday, and which were considered – by the analysts and many readers – as quite optimistic.

Morgan Stanley says its analysis is based on estimated installation costs for a Tesla 7kWh daily cycle battery system paired with a 3kW solar PV system.

Morgan Stanley says the preference for most Australian households suggests a pay-back period of 10 years or less is preferable, but doesn’t really matter when the product becomes ‘mainstream’ and the upfront cost drops to ‘appliance’ levels of around $A5,000, which is comparable to a large television.

“We think the ‘retrofit’ market, i.e. the ~1.1m households with solar panels already installed, will be among the first households to adopt the new battery products, potentially combined with the upsizing of older 1.5-2kW systems,” it says.

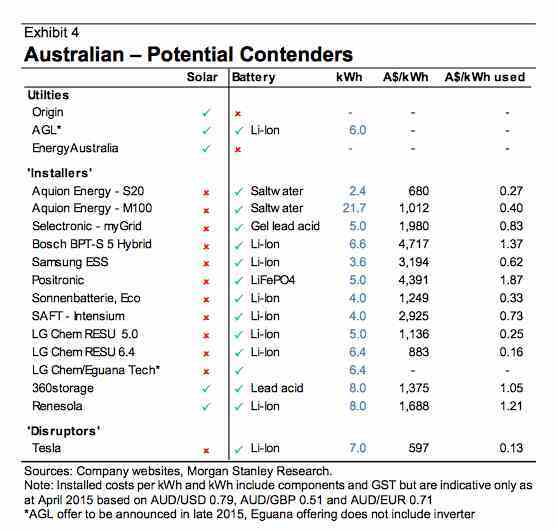

So, who are the winners from all this? Morgan Stanley says it is hard to say. It does rank the potential players in the market, from utilities, product developers and the real “disruptors” such as Tesla – and maybe even Google and Apple down the track.

Morgan Stanley says the arrival of Tesla’s PowerWall product in Australia, expected in early 2016, will catalyse the sector and lead to rapid take-up of battery storage, with fast-follower installers and competing products entering the market over time.

“Just as Australia does not have the venture capital, labour and supply chain to compete with global electronic brands such as Apple and Samsung, we think Australian incumbents are at risk of losing market share to new entrant disruptors.”

But it does suggest that the utilities could take advantage of what it calls the “easy adopters”, those that want to install battery storage without thinking about it too hard. It even suggests that the likes of some electricity retailers could invest back up the supply chain

As for the utilities, Morgan Stanley estimates that they could see reductions in earnings before interest and tax of up to $100 million in 2020, as consumers choose to store the output from their solar arrays in battery storage.

This so-called “load shedding” will cut around 800GWh for each utility, and about 3 TWh for the NEM. Morgan Stanley expects as big an impact from battery storage as the first wave of household solar and energy efficiency between 2009 and 2013.

Interestingly, Morgan Stanley notes that while the utilities may be able to erect defensive walls with tariffs (and higher fixed charges) and the help of pricing and policy regulators, that may not cut much ice with their consumers, who then face higher bills.

“Put simply, we think that energy retailers will struggle to explain the changes to their customers, especially where bills are going up despite usage going down.

“Our AlphaWise survey supports this view, with customers displaying very low awareness of tariff structures, and a strong belief that reducing consumption is the best way to reduce cost.”

And the utilities face write-downs too. If battery capacity reached around 10 per cent of NEM generation capacity in the early 2020s, that would replace the need for much of the gas-fired peaking plant installed today.

© 2015 Solar Choice Pty Ltd

Technology development is far from over. In fact we are now in the technology age. Batteries, PV panels, and associated equipment will only get better, more efficient and cheaper too for the consumer. The challenge for the central generators and particularly distribution networks is to make their supply competitive with that because in the end the market will decide the outcome. Inventing arbitrary charges such as “Service charges” and “Peak and Low times” and “Meter Fees” and all the rest of that kind of nonsense are coming to an end as technology makes independent residential generation within the reach of all. Wake up networks and become competitive and relevant while you still have the chance.

It sends a clear message to the electricity providers. If they don’t increase the buyback offer for PV electricity to the system owners, we will just install batteries.