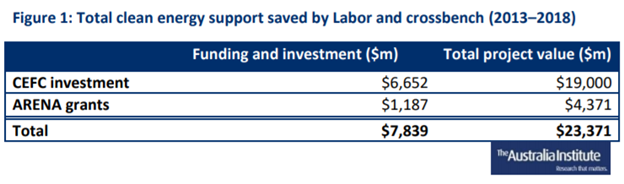

A new report from The Australia Institute (TAI) has shown the crossbench’s role in saving 3 renewable energy policies (The CEFC, ARENA and the RET) from being abolished by the Coalition Government. The report cites that these three policies have been responsible for ~$23BN of investment into renewable energy projects during 2013 to 2018.

Clean Energy Finance Corporation (CEFC)

The CEFC is a government-owned green bank which is responsible for investing in clean energy projects. A primary method of encouraging investment in the sector has been through partnering with Australia’s major banks to enable discounts on loans provided to energy efficiency projects, as well as providing direct contributions to large-scale renewable projects. TAI reports that during 2013-2018 CEFC has invested $6.7BN into projects that value $19BN in total.

Australian Renewable Energy Agency (ARENA)

Arena’s objective is to accelerate Australia’s shift to affordable reliable renewable energy. Compared to the CEFC, ARENA focuses on early-stage technologies providing investment support to improve commercial viability. A good example of this is Tesla’s big battery at the Gannawarra Solar Farm, for which Solar Choice was the originating developer. Through the same period TAI hightlights ARENA’s $1.2BN of investment in a total project value of $4.4BN.

Renewable Energy Target (RET)

The RET through its widely popular small-scale renewable energy scheme has contributed to the installation of over 806,000 solar panel systems according to the report. Additionally, the RET is responsible for driving the uptake of solar hot water systems and the increasing growth in large-scale solar projects.

The report suggests that Australia has the crossbench to thank that these schemes are still around today, as most efforts of the Tony Abbott and Scott Morrison governments to disassemble them have been blocked by the Labor Opposition and Green Candidates in the Senate.

- Solar Panel Costs: Solar Choice Price Index | April 2025 - 1 April, 2025

- Solar Panels For Homes – All You Need to Know About Solar Systems - 18 March, 2025

- Best NSW Solar Feed-In Tariffs - 17 March, 2025