The Chinese government released a report detailing its ambitious near-term targets for solar PV manufacturing over the course of the nation’s 12th 5-year plan, which began in 2011. The plan calls for 50,000 tons of annual polysilicon production and 5 gigawatts of solar PV cell production capacity by 2015, as well as a number of other goals related to solar efficiency and price.

China: Shaping the global solar panel industry

What happens in China will have major impacts on the both the short- and long-term future of the solar PV industry. In the short term, the plan will drive competition in an already tight market that witnessed the collapse of several key American solar manufacturers in 2011. A flood of Chinese solar system components onto the global market is one of the major factors driving the price of solar PV systems down globally, forcing many manufacturers to scale back production or sell panels just to keep inventory moving.

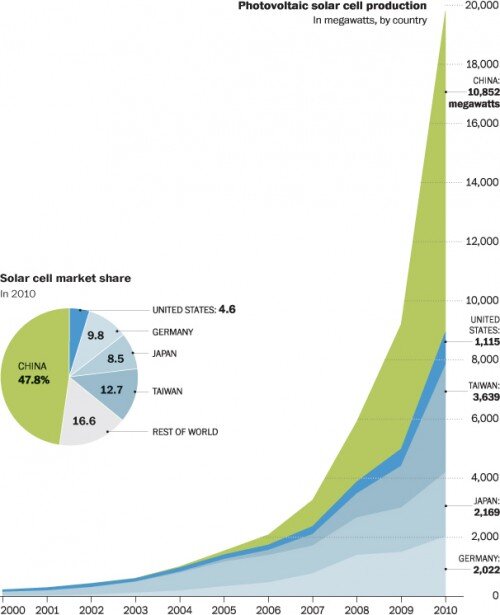

Some Chinese manufacturers are suspected to be selling below cost, enabled in part by a buffer of government support, but also copping losses on their own bankbooks just to stay in the game. There are huge amounts of solar panels currently being made in China (there are literally hundreds of manufacturers), and nearly half the global solar market belongs to China.

A good proportion of the China’s manufacturing capacity currently belongs to smaller, ‘generic’ companies, which have no unique selling points or research & development teams of their own. Bloomberg predicts that the hundreds of manufacturers will consolidate into approximately 15 companies within the next 5 years due to global oversupply of stock and increased competition. The survivors will likely be the big players–Suntech, Trina, Yingli, Sun-Earth, and a handful of others. The losers will be the Chinese generics, as well as possibly some North American and European brands.

China’s government-directed economic system is the key to the setting of such clear and bold goals. Manufacturers in Europe and North America are not backed as strongly as their Chinese counterparts by government subsidies, nor have any Western governments made such a bold and explicit goal of directly supporting their domestic solar manufacturing industry to this degree. It was the issue of subsidisation that became the focus of a trade row between US and Chinese solar PV manufacturers, in which the Chinese industry was accused of unfair trade practices and of ‘dumping’ stock on the market. Judging by the targets set out in the government report, however, it does not appear that China will be allowing this trade row to prevent its rise to global dominance in solar.

This paints a picture of the current situation: North American and European solar companies–who generally offer high-end products–having difficulty competing with Tier 1 Chinese products, which are affordable and generally good quality (without necessarily being premium). All the while, the Chinese industry sheds its expendable generic companies.

For the rest of the world, all of this means that solar PV prices can be expected to continue falling until domestic demand in China picks up and begins to absorb most of the extra capacity. This seems to be China’s ultimate aim, having increased its cumulative installed solar generation capacity target by 50%–up to 15 gigawatts–by 2015. This target will be backed-up and complemented by the country’s nation-wide solar feed-in tariff.

Other solar power targets

The report trumpeting China’s solar manufacturing goals includes a number of other targets related to solar PV. These included a general call for increased research & development in the solar industry, and a more specific call to see monocrystalline solar cells of 21% efficiency, polycrystalline cells of 19% efficiency, and amorphous thin-film cells of 12% efficiency. (More on the types of solar panels.) It also calls for a reduction in the price of solar PV to the equivalent of USD$1 per watt by 2015.

© 2011 Solar Choice Pty Ltd

- Solar Power Wagga Wagga, NSW – Compare outputs, returns and installers - 13 March, 2025

- Monocrystalline vs Polycrystalline Solar Panels: Busting Myths - 11 November, 2024

- Solar Hot Water System: Everything You Need to Know - 27 February, 2024