There is a phenomenal amount of buzz about home battery storage in Australia – it’s a hot topic because of the potential value proposition and the allure of energy independence. But does battery storage yet make sense for Australian homes? Yes, in some circumstances – which we discuss in this article.

Some background: Going solar in Australia in 2016

Rooftop solar by itself (without batteries) is a good investment almost everywhere in Australia. Thanks to low solar system prices (which we keep monthly track of) and high retail electricity prices, a system can have a payback time as short as 2-3 years (e.g. 3kW solar system in Brisbane for home that uses about 25kWh of energy per day – assumes the home manages to use nearly all (80%) of the energy produced). Check out our simple ‘solar only’ payback estimator here.

Rooftop solar by itself (without batteries) is a good investment almost everywhere in Australia. Thanks to low solar system prices (which we keep monthly track of) and high retail electricity prices, a system can have a payback time as short as 2-3 years (e.g. 3kW solar system in Brisbane for home that uses about 25kWh of energy per day – assumes the home manages to use nearly all (80%) of the energy produced). Check out our simple ‘solar only’ payback estimator here.

The key to getting the most out of a solar system in Australia these days is to ‘self-consume’ as much of the energy as possible – i.e. use the solar energy directly to reduce the amount of energy that needs to be purchased from their electricity retailer. Any solar energy sent into the grid is worth almost nothing for new system owners (although the opposite is true for homes on legacy feed-in tariffs, which are closed to new applicants). This means solar homes should try to run as many appliances as possible during the daylight hours (e.g. on timers) to maximise their solar usage.

It also means that solar system owners need to choose a system that fits their electricity demand level and consumption pattern – generally speaking, a system that is too large will offer less value than a system that is too small. (Read more: How to get the most out of your solar system – Select the right system size and Know your electricity consumption habits.) We have a simple solar system sizing estimator tool here.

Compare solar installation quotes instantly: Complete our Solar Quote Comparison request form on the right of this page.

Battery storage in 2016: Why it’s starting to make sense and how

It’s against this background that battery storage has become such an appealing prospect – solar system owners don’t like that their exported solar energy is worth to little (6-8c/kWh in most places) to their electricity retailer. Rather than send it into the grid at a pittance, they think that they might be able to save money by storing this energy for their own use at night. There’s also the appeal of having greater energy independence. However, the financials of battery storage do not yet stack up: Remember that they do not create energy, they only store it.

Many urban residents ask us about going off the grid, but soon shy away from the idea once they learn about the costs. The main reason an off-grid system is so expensive is because you have to plan for several days without sunshine, so you need redundancy in the system’s capacity – both extra solar to fill up the batteries and lots of battery capacity (a good portion of which will only be used a few times a year, when there have been successive days of heavy rain). Staying grid-connected means that you can always rely on the grid, rain or shine. If your home is on the fringe of grid and you have no existing electrical connection, however, it might make sense.

Having batteries installed will certainly save you money on your electricity bill, but due to fixed daily usage charges (in the range of $0.85-$1.50 per day), it is virtually impossible to reduce your bill to $0 as long as you are grid-connected (so be wary of solar companies who promise otherwise).

There are actually two main ways that batteries can save money for a grid-connected home:

There are actually two main ways that batteries can save money for a grid-connected home:

- Store excess solar energy for later use. This is the simplest option that makes the most obvious sense to solar homes.

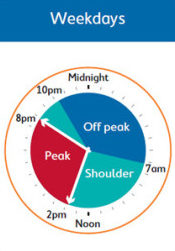

- ‘Tariff arbitrage‘ – storing energy from the grid when it is cheap for use at a later point in time when it is expensive. This can only be done if you are on a Time of Use electricity tariff, and only with some solar/battery storage system set-ups which allow you to charge your batteries using the grid.

Tariff arbitrage actually makes a big difference for battery system value, significantly reducing payback times in many scenarios.

At current battery prices, a solar+battery storage installation will almost always have a longer payback than a conventional solar-only installation. Battery system retrofits are tend to have longer payback periods – especially where tariff arbitrage is not used.

Many installers are selling ‘battery-ready’ solar systems, where the inverter can easily accept battery input at a later date. This is not a bad approach for consumers who wish to install batteries at a later date (when they’re less expensive), but there is the chance that it might be limiting when it comes to eventually adding the batteries on (e.g. what batteries can the inverter accept?)

Many installers are selling ‘battery-ready’ solar systems, where the inverter can easily accept battery input at a later date. This is not a bad approach for consumers who wish to install batteries at a later date (when they’re less expensive), but there is the chance that it might be limiting when it comes to eventually adding the batteries on (e.g. what batteries can the inverter accept?)

Currently, a fully installed lithium-ion battery bank (let’s ignore lead acid, which is cheaper but better for off-grid for a few reasons) costs between $1,000 – $2,000 per kilowatt-hour (kWh) of storage capacity. Most analysts think that mass market adoption will begin around the $500/kWh mark – at this point the financial case will be significantly more compelling.

Some example scenarios where battery storage is starting to make sense

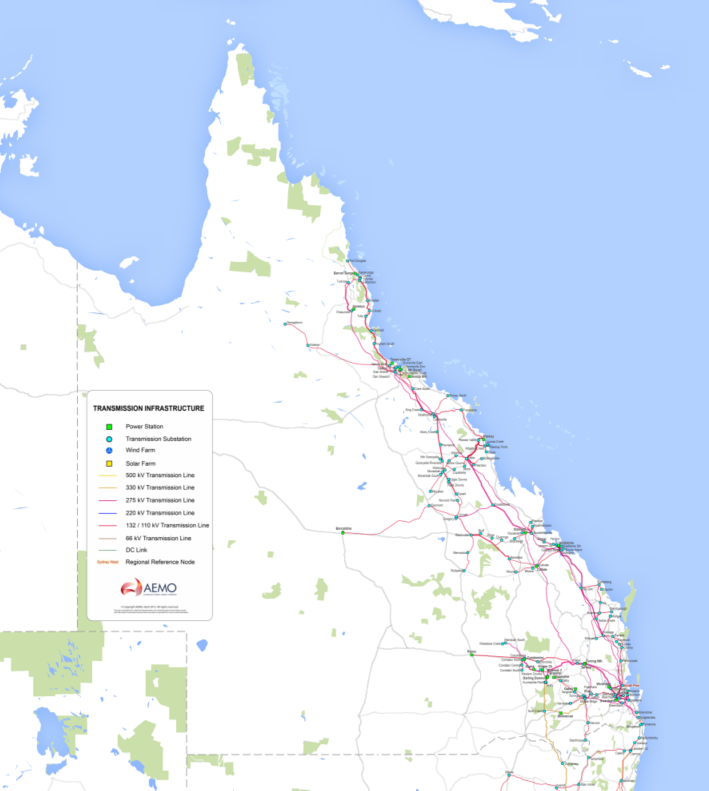

A) A regional Queensland home at the fringe of grid with no existing connection

A) A regional Queensland home at the fringe of grid with no existing connection

Let’s consider a household in regional Queensland for whom it would cost around $25,000 to get a grid connection on a new property (actual costs vary significantly depending on location and network company). The occupants are a retired couple without any unusual electrical needs, using about 15kWh on the average day throughout the year (20kWh/day in summer, 12kWh in winter).

In this case, they could probably get by on an 8kW solar system and 30kWh of usable battery storage capacity (n.b. not all batteries can be discharged completely without harming their ability to hold a charge). In this case you might pay about $10,000 for the solar and about $30,000 for the batteries – $40,000 in total. Compared to paying the $25,000 for the grid connection and then approximately another $22,000 over the course of the next 10 years (assuming $1.30 daily supply charge plus $0.25/kWh usage charge), then you’d probably come out ahead by going off-grid.

Keep in mind, however, that you’re out of luck if the system cuts out on you (can’t blame the electricity company!), and that you’d have to increase the size of your system if your usage patterns increased. Additionally, there’s the outside chance you might need to ration energy a couple of times/year (unless you get a generator, which will be expensive, costly to run and will sit unused the vast majority of the time).

B) Sydney homes coming off the NSW Solar Bonus Scheme at the end of the year

In addition to the visceral feelings of loss that these homes will have when their feed-in tariff drops from 60c/kWh to ~6c/kWh, there will be some real potential to save money for these homes. Many of the solar systems installed under the Solar Bonus Scheme were in the range of 1.5-2kw in capacity, which is quite small by today’s standards (3-5kw being standard across Aus these days).

If a household that has a north-facing 2kW system and uses 20kWh of energy per day, they could install a 4kWh (usable) battery bank for $3,500 and see a payback of about 5 years – provided that a) they charge with the grid in addition to with solar (tariff arbitrage for 2nd cycle per day), b) are on time-of-use billing with a high differential between peak and off-peak/shoulder, c) use the bulk of their energy during the day and only a little during the daytime (‘evening peak’ usage pattern), and d) make sure that they only discharge their batteries during peak/shoulder times (the system should be programmable to do so).

The above may also be true for South Australian and Victorian homes on the Transitional feed-in tariffs (which end in the near future).

(N.b. Enphase’s modular AC batteries may be the most well-suited battery solution for this scenario.)

C) Brisbane home with minimal electricity demand (and willing to go off-grid)

This is admittedly an unlikely scenario, but imagine a Brisbane home that uses only 5kWh per day (an ultra-efficient home – probably already extremely energy/environmentally conscious). Because their usage is so low, a 4kW solar system (for a low price of $4,000) would generate more energy than they need on a daily basis. Already so close to being energy self-sufficient, such a home might consider going off the grid in order to avoid paying their retailer’s daily supply fees (roughly $1-$1.30/day). With 14kWh of battery capacity for $15,000 (approximately 2x Tesla Powerwalls or an expanded LG Chem RESU), this home could save around $18,000 over the next 15 years (at which time the battery bank and inverter would most likely need replacing).

Realistically, however, this home will just barely be breaking even at the 20 year mark. It’s also important to keep in mind that batteries grow slightly less efficient each year, which could mean that an earlier replacement may be required. (Panel efficiency also decreases, but at a slower rate than batteries.)

Realistically, however, this home will just barely be breaking even at the 20 year mark. It’s also important to keep in mind that batteries grow slightly less efficient each year, which could mean that an earlier replacement may be required. (Panel efficiency also decreases, but at a slower rate than batteries.)

In summary

- Investing in energy efficiency and ensuring you’re on a good electricity plan are the first step for any home considering investing in solar and/or storage.

- Once the home is as efficient as possible, a solar PV only system is the next best investment. Systems should be sized to meet a home’s daytime electricity demand as closely as possible – without exporting much solar into the grid.

- Battery storage pricing (specifically for lithium-ion) currently sits at around $1,000-$2,000 per kilowatt-hour (kWh) of capacity. Battery storage will be closer to the ‘no brainer’ status of solar PV only once it starts to hit the $500/kWh mark – still a few years off. (Although many lead acid batteries achieve this price point, they cannot ‘take a beating’ to the same extent as lithium-ion and generally have shorter lifespans.)

- That being said, there are some situations (outlined above) where storage is already starting to make sense. But key to getting the most out of a grid-connected battery storage bank is tariff arbitrage (buying electricity on the cheap and using it when elec is expensive). The returns look best when batteries are installed alongside a new solar system instead of retrofitted. Retrofitted battery banks have the longest payback periods – especially when they do not take advantage of tariff arbitrage.

- However, some homes might want to have a ‘battery ready’ solar system installed for easy future battery retrofitting when battery storage prices have come down a bit.

- Companies like Reposit Power promise to improve the financial case for batteries. Electricity retailers that they’re aligned with (currently only Diamond Energy) offer premium payments when their customers export stored energy into the grid during ‘peak pricing events’. However, it’s still unclear how frequently these events will occur. At least for now it’s safe to say that most battery system owners will benefit mainly from increasing their energy self-reliance and from tariff arbitrage.

Ready to shop for solar and batteries? Compare solar quotes from installers in your area.

© 2016 Solar Choice Pty Ltd

- Monocrystalline vs Polycrystalline Solar Panels: Busting Myths - 11 November, 2024

- Solar Hot Water System: Everything You Need to Know - 27 February, 2024

- Can I add more panels to my existing solar system? - 8 August, 2023

What if you’re a Brisbane home with low energy use and don’t mind losing power every once in a while? The few times a year Brisbane suffers more than a couple of days of overcast weather is usually during tropical storm season in summer, in which case you’re just as likely to lose conventional power due to broken power lines (happens every year without fail where I live). It gives you a chance to clean out the fridge and you don’t need hot water in 35 degrees celsius and 100% humidity. Instead of buying large expensive batteries for the 3 times in a year that they will be needed just go a few days without power and literally save tens of thousands of dollars.